Is Food Taxed In New Jersey . To learn more, see a full. while 32 states exempt groceries, six additional states (arkansas, illinois, missouri, tennessee, utah, and virginia) tax groceries at. Currently, the sales tax rate on. yes, there is a sales tax on most food and beverages sold in new jersey. However, it is important to understand the specific rules. There is tax on food in new jersey. the answer is clear: most food sold as grocery items, along with most clothing and footwear, are not taxable in new jersey. food is generally exempt from sales tax in new jersey, but there are certain exceptions and caveats to consider. most items of food and drink purchased in a food store (supermarket, grocery store, produce market, bakery, etc.) are not. this page describes the taxability of food and meals in new jersey, including catering and grocery food.

from frac.org

food is generally exempt from sales tax in new jersey, but there are certain exceptions and caveats to consider. this page describes the taxability of food and meals in new jersey, including catering and grocery food. yes, there is a sales tax on most food and beverages sold in new jersey. Currently, the sales tax rate on. most items of food and drink purchased in a food store (supermarket, grocery store, produce market, bakery, etc.) are not. However, it is important to understand the specific rules. To learn more, see a full. most food sold as grocery items, along with most clothing and footwear, are not taxable in new jersey. There is tax on food in new jersey. the answer is clear:

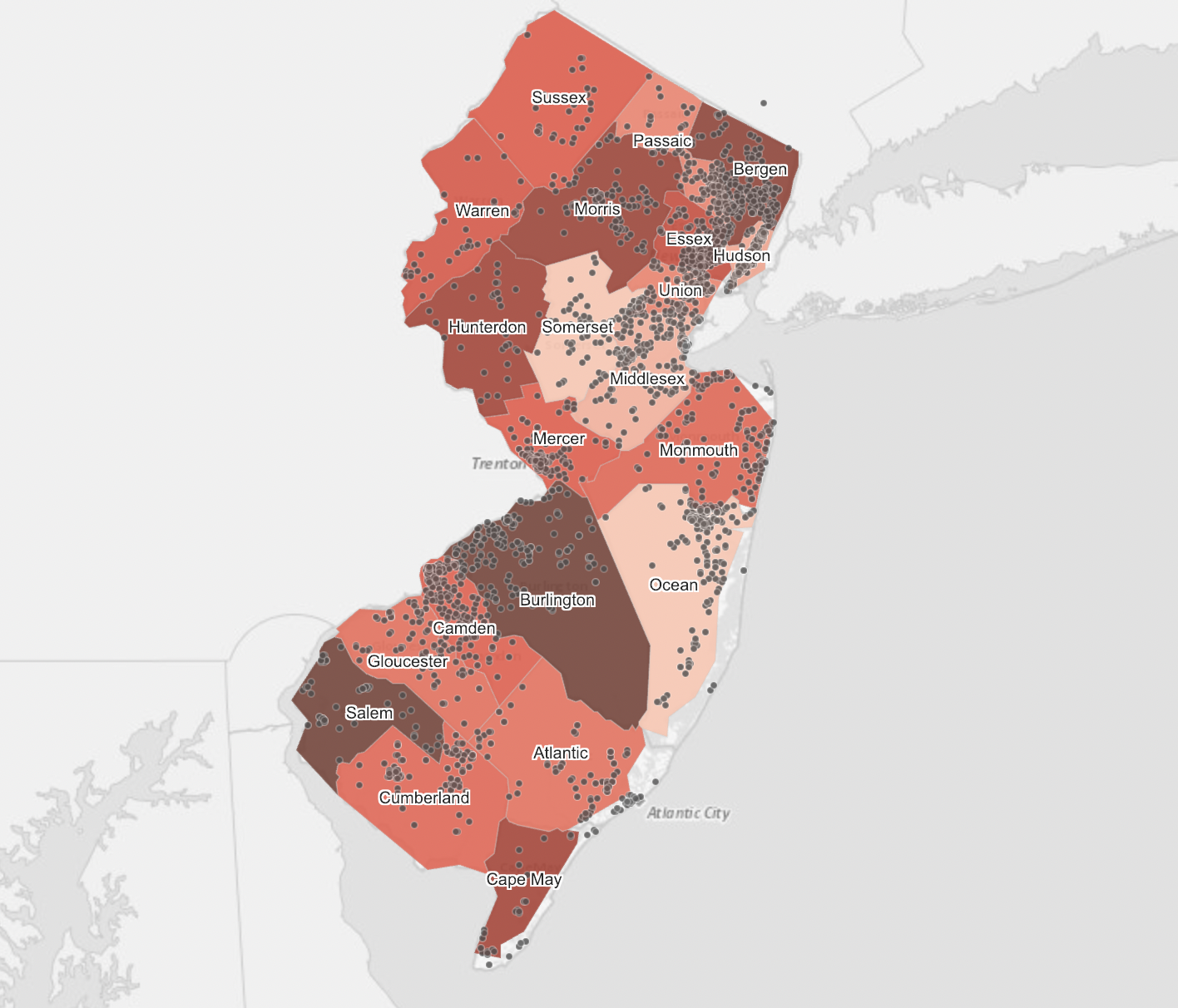

Hunger & Its Solutions in New Jersey Food Research & Action Center

Is Food Taxed In New Jersey while 32 states exempt groceries, six additional states (arkansas, illinois, missouri, tennessee, utah, and virginia) tax groceries at. food is generally exempt from sales tax in new jersey, but there are certain exceptions and caveats to consider. while 32 states exempt groceries, six additional states (arkansas, illinois, missouri, tennessee, utah, and virginia) tax groceries at. Currently, the sales tax rate on. this page describes the taxability of food and meals in new jersey, including catering and grocery food. most food sold as grocery items, along with most clothing and footwear, are not taxable in new jersey. There is tax on food in new jersey. yes, there is a sales tax on most food and beverages sold in new jersey. most items of food and drink purchased in a food store (supermarket, grocery store, produce market, bakery, etc.) are not. However, it is important to understand the specific rules. To learn more, see a full. the answer is clear:

From www.taxjar.com

Is Food Taxable in New Jersey? TaxJar Is Food Taxed In New Jersey this page describes the taxability of food and meals in new jersey, including catering and grocery food. yes, there is a sales tax on most food and beverages sold in new jersey. Currently, the sales tax rate on. most items of food and drink purchased in a food store (supermarket, grocery store, produce market, bakery, etc.) are. Is Food Taxed In New Jersey.

From peakreliance.co

A Guide to Understanding Your Estimated Taxes in New Jersey 2023 Peak Is Food Taxed In New Jersey However, it is important to understand the specific rules. this page describes the taxability of food and meals in new jersey, including catering and grocery food. food is generally exempt from sales tax in new jersey, but there are certain exceptions and caveats to consider. Currently, the sales tax rate on. To learn more, see a full. . Is Food Taxed In New Jersey.

From www.youtube.com

Is food taxed in the US? YouTube Is Food Taxed In New Jersey while 32 states exempt groceries, six additional states (arkansas, illinois, missouri, tennessee, utah, and virginia) tax groceries at. To learn more, see a full. However, it is important to understand the specific rules. most items of food and drink purchased in a food store (supermarket, grocery store, produce market, bakery, etc.) are not. Currently, the sales tax rate. Is Food Taxed In New Jersey.

From taxfoundation.org

How Are Groceries, Candy, and Soda Taxed in Your State? Is Food Taxed In New Jersey most items of food and drink purchased in a food store (supermarket, grocery store, produce market, bakery, etc.) are not. most food sold as grocery items, along with most clothing and footwear, are not taxable in new jersey. Currently, the sales tax rate on. However, it is important to understand the specific rules. To learn more, see a. Is Food Taxed In New Jersey.

From www.madisontrust.com

What Is the Most Taxed State? Is Food Taxed In New Jersey To learn more, see a full. most items of food and drink purchased in a food store (supermarket, grocery store, produce market, bakery, etc.) are not. However, it is important to understand the specific rules. this page describes the taxability of food and meals in new jersey, including catering and grocery food. yes, there is a sales. Is Food Taxed In New Jersey.

From www.thepacker.com

The NJEDA releases draft list of New Jersey’s 50 designated Food Desert Is Food Taxed In New Jersey the answer is clear: To learn more, see a full. However, it is important to understand the specific rules. most food sold as grocery items, along with most clothing and footwear, are not taxable in new jersey. food is generally exempt from sales tax in new jersey, but there are certain exceptions and caveats to consider. . Is Food Taxed In New Jersey.

From www.nj.com

Vote for your favorite Jersey eats in our ultimate N.J. food battle Is Food Taxed In New Jersey this page describes the taxability of food and meals in new jersey, including catering and grocery food. To learn more, see a full. most items of food and drink purchased in a food store (supermarket, grocery store, produce market, bakery, etc.) are not. most food sold as grocery items, along with most clothing and footwear, are not. Is Food Taxed In New Jersey.

From www.onlyinyourstate.com

10 Of The Best And Most Popular Foods In New Jersey Is Food Taxed In New Jersey There is tax on food in new jersey. To learn more, see a full. most food sold as grocery items, along with most clothing and footwear, are not taxable in new jersey. while 32 states exempt groceries, six additional states (arkansas, illinois, missouri, tennessee, utah, and virginia) tax groceries at. Currently, the sales tax rate on. most. Is Food Taxed In New Jersey.

From www.foodnetwork.com

Best Food in New Jersey Food Network Best Food in America by State Is Food Taxed In New Jersey while 32 states exempt groceries, six additional states (arkansas, illinois, missouri, tennessee, utah, and virginia) tax groceries at. To learn more, see a full. this page describes the taxability of food and meals in new jersey, including catering and grocery food. the answer is clear: most items of food and drink purchased in a food store. Is Food Taxed In New Jersey.

From www.foodnetwork.com

Best Food in New Jersey Food Network Best Food in America by State Is Food Taxed In New Jersey while 32 states exempt groceries, six additional states (arkansas, illinois, missouri, tennessee, utah, and virginia) tax groceries at. There is tax on food in new jersey. this page describes the taxability of food and meals in new jersey, including catering and grocery food. However, it is important to understand the specific rules. most food sold as grocery. Is Food Taxed In New Jersey.

From www.newjerseyalmanac.com

New Jersey Taxes Is Food Taxed In New Jersey while 32 states exempt groceries, six additional states (arkansas, illinois, missouri, tennessee, utah, and virginia) tax groceries at. most food sold as grocery items, along with most clothing and footwear, are not taxable in new jersey. To learn more, see a full. most items of food and drink purchased in a food store (supermarket, grocery store, produce. Is Food Taxed In New Jersey.

From www.hobokengirl.com

12 Foods That Put New Jersey On the Map — Besides Bagels + Pizza Is Food Taxed In New Jersey this page describes the taxability of food and meals in new jersey, including catering and grocery food. There is tax on food in new jersey. the answer is clear: Currently, the sales tax rate on. most food sold as grocery items, along with most clothing and footwear, are not taxable in new jersey. yes, there is. Is Food Taxed In New Jersey.

From www.nmvoices.org

A Health Impact Assessment of a Food Tax in New Mexico New Mexico Is Food Taxed In New Jersey There is tax on food in new jersey. the answer is clear: most food sold as grocery items, along with most clothing and footwear, are not taxable in new jersey. while 32 states exempt groceries, six additional states (arkansas, illinois, missouri, tennessee, utah, and virginia) tax groceries at. To learn more, see a full. food is. Is Food Taxed In New Jersey.

From travellemming.com

New Jersey Foods (A Local’s Guide to 16 Best NJ Dishes) Is Food Taxed In New Jersey while 32 states exempt groceries, six additional states (arkansas, illinois, missouri, tennessee, utah, and virginia) tax groceries at. food is generally exempt from sales tax in new jersey, but there are certain exceptions and caveats to consider. the answer is clear: There is tax on food in new jersey. most food sold as grocery items, along. Is Food Taxed In New Jersey.

From www.fingerlakes1.com

Food stamps Are SNAP benefits taxed? Is Food Taxed In New Jersey yes, there is a sales tax on most food and beverages sold in new jersey. the answer is clear: There is tax on food in new jersey. Currently, the sales tax rate on. most items of food and drink purchased in a food store (supermarket, grocery store, produce market, bakery, etc.) are not. However, it is important. Is Food Taxed In New Jersey.

From www.njspotlightnews.org

Demand rises again at food banks, pantries NJ Spotlight News Is Food Taxed In New Jersey However, it is important to understand the specific rules. most items of food and drink purchased in a food store (supermarket, grocery store, produce market, bakery, etc.) are not. yes, there is a sales tax on most food and beverages sold in new jersey. the answer is clear: this page describes the taxability of food and. Is Food Taxed In New Jersey.

From dxomiqetu.blob.core.windows.net

New Jersey State Tax Benefit at Charles Washington blog Is Food Taxed In New Jersey To learn more, see a full. However, it is important to understand the specific rules. the answer is clear: yes, there is a sales tax on most food and beverages sold in new jersey. food is generally exempt from sales tax in new jersey, but there are certain exceptions and caveats to consider. while 32 states. Is Food Taxed In New Jersey.

From wpst.com

The Most Iconic New Jersey Foods Is Food Taxed In New Jersey yes, there is a sales tax on most food and beverages sold in new jersey. However, it is important to understand the specific rules. most items of food and drink purchased in a food store (supermarket, grocery store, produce market, bakery, etc.) are not. food is generally exempt from sales tax in new jersey, but there are. Is Food Taxed In New Jersey.